Goldman Sachs - Marcus

While at McKinsey, I led a project to develop the new business/brand, Marcus, from Goldman Sachs (GS). I led a team of five designers and developers among a much larger McKinsey team. Our research fed the value proposition for the business unit and our design work led to the first Marcus product which was for consumer lending.

Marcus moved Goldman down-market out of their existing client base and represented risk but McKinsey was able to convince them to move forward and it was the first time (that I’m aware of) where the two worked together. Of the four product options McKinsey presented to Goldman, a lending product seemed to have the most potential given the success of products like Lending Club.

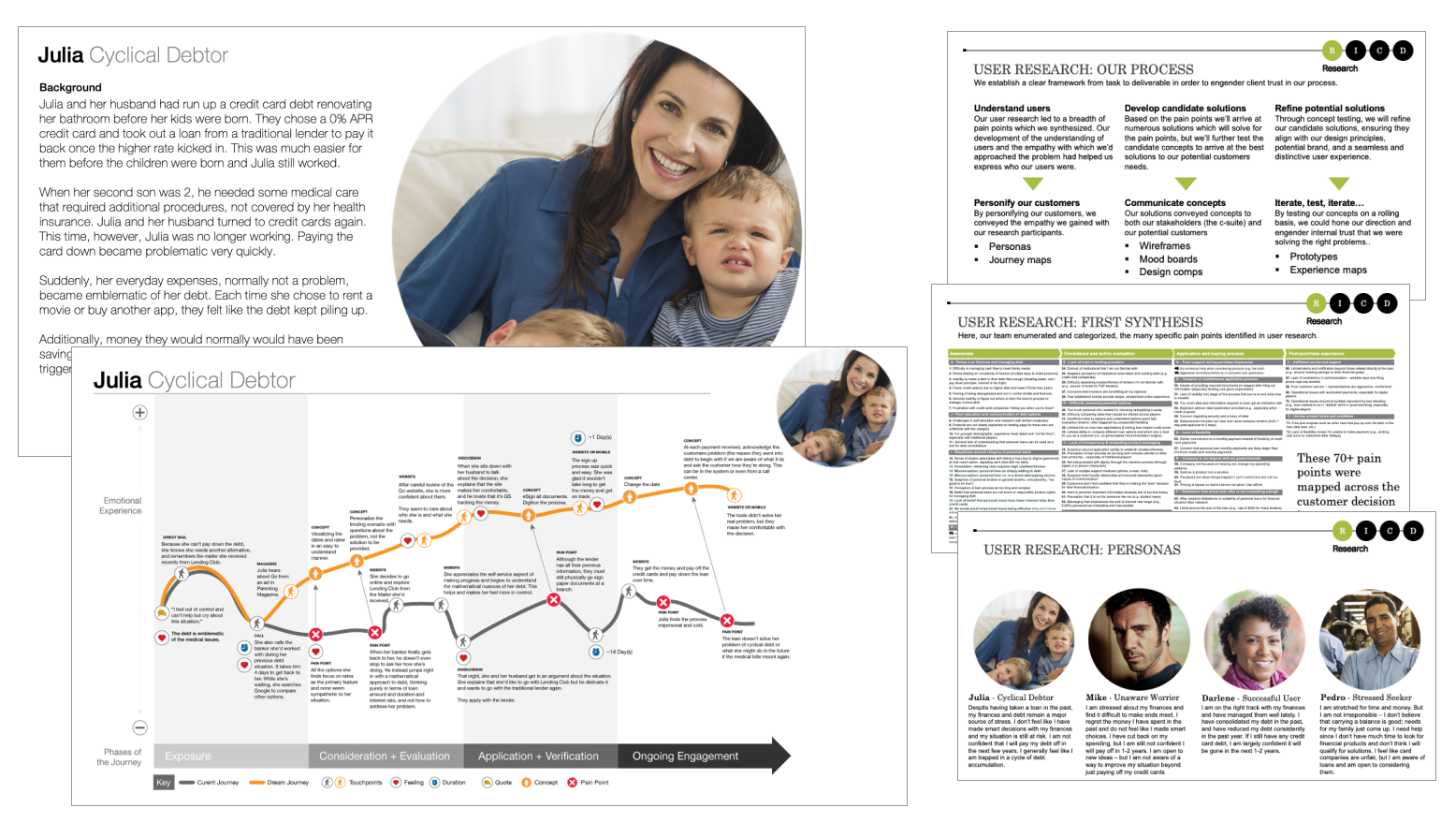

Generative User Research was conducted with twenty-three, 2hr one-on-one interviews, a survey with over 1000 participants, and several focus groups.

Some of the biggest insights were that trust, especially for cyclical debtors, was paramount.

In addition we did an extensive competitive and comparative analysis which fed a brand development framework and design principles. We achieved a cohesive foundation on which to build the brand and product.

User-centered Design was critical to communicating the value proposition to the GS. We built robust personas based on our extensive research with a focus on customer journeys - both existing and future.

We prepared huge posters of these and they were key deliverables in a gating meeting with the Goldman executive team.

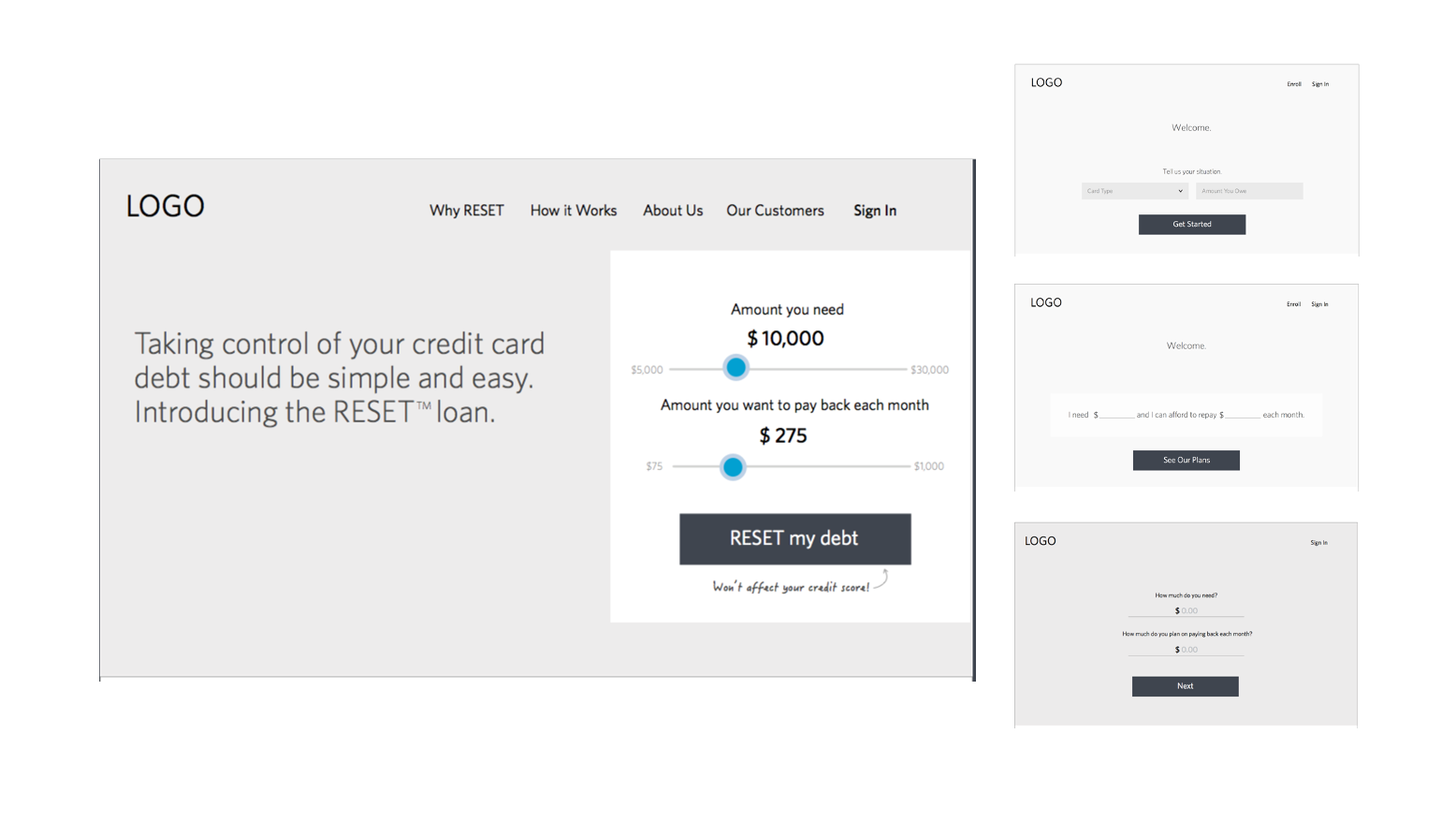

At this point we began to create bare bones wireflows to pressure test concepts. We user tested every 2 weeks with approximately 12 participants each in one-on-one sessions in order to gauge interest, use, and understanding.

This Evaluative Research became a favorite to the CEO of the Marcus group. We tested everything including multiple iterations of the product interface, information architecture, labels, and brand concepts including taglines and names.

Among interactions we explored were information visualizations that clarified a person's existing debt size against that debt using Marcus. One of the core value propositions was the interest rates Marcus offered.

These visualizations proved so popular and useful among our test participants that we expanded their use across the application. They helped reveal the debt size but also monthly payments and time to pay down the debt along with potential packages of service.

We developed a faux identity called Reset so our participants wouldn't be biased by the GS brand while we developed the Marcus brand.

My team delivered an outstanding experience and although Marcus is very much evolved from the work we did originally, our core work established a solid brand.

Our IMPACT was massive. In it’s first two years, the Marcus lending product made 2b and was recognized as the fastest fintech to reach that point, ever.

Marcus moved Goldman down-market out of their existing client base. Of the four options McKinsey presented to Goldman, the lending product seemed the most accessible, especially given the success of products like Lending Club at the time.

Generative User Research was conducted with twenty-three, 2hr one-on-one interviews, a survey with over 1000 participants, and several focus groups. Some of the biggest insights were that trust, especially for cyclical debtors, was paramount.

Among the deliverables were many PowerPoint decks as one would expect from McKinsey. However, Design was critical to communicating the reason for the product in the first place which was that people like Julia, one of our personas, would readily use Marcus if it were designed for their needs. We paid very close attention to the persona and journey development and they were key deliverables in a gating meeting with the Goldman executive team.

In addition to the Generative User Research, our team held Evaluative sessions every two weeks to validate concepts and incorporate user feedback into the process.

Each session brought our conceptual model closer to reality. We knew we had to provide simple, accessible tools...users didn't want to think they were interacting with their bank. These wires and flows helped communicate our ideas and prove the efficacy to the client.

Critical to our interactions were information graphics that clarified a person's existing debt and how a tool like Marcus could decrease that debt, by reducing the interest rates we offered. This info vis helped reveal the debt size making comparison easier for our potential customers and this was validated in the User Research.

We developed a faux identity called Reset so our participants wouldn't be biased by the GS brand. My team delivered an outstanding experience and although Marcus is very much evolved, the core work we did established a solid brand.